Are you looking for assumable mortgages but not sure where to start? This article cuts straight to the chase, equipping you with practical strategies for tracking down loans that can be assumed, detailing how to navigate the real estate market, and pinpointing exactly where you should be looking. Keep reading for an easy-to-understand guide on finding assumable mortgages and potentially cutting down your expenses in the current housing market.

Key Takeaways

- Assumable mortgages allow buyers to take over a seller’s loan under its original terms, often leading to savings in interest rates and monthly payments but are typically limited to government-backed loans like FHA, VA, or USDA.

- To find homes with an assumable mortgage, utilize specialized online platforms, consult with knowledgeable real estate agents, and engage in networking to get insider information on available listings.

- When considering an assumable mortgage, it’s important to meet lender requirements such as credit scores and debt-to-income ratios, budget for upfront costs like the seller’s equity, and navigate legal aspects with the help of professionals.

Unlocking the Potential of Assumable Mortgages

An assumable mortgage, or assumable loan, allows a homebuyer to take over the seller’s existing mortgage terms unchanged. In this scenario, you as the buyer adopt all the conditions of the original agreement and step into what was once solely reserved for the seller. Homes with an assumable mortgage give you, as a potential homeowner, a unique financial option that is quite attractive.

It must be noted that not every loan is suitable for assumption. Typically loans underwritten by entities such as the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or United States Department of Agriculture (USDA) carry features allowing them to be assumed by a new borrower who takes on all obligations from where they left off when transferring ownership. Conversely, most conventional mortgages don’t support assumptions unless specific circumstances are met.

Assuming a mortgage can offer substantial benefits through locked-in lower interest rates, which may result in significant savings on monthly payments and could reduce total costs considerably over time.

Discovering Homes with Assumable Loans

If you’ve been thinking about the advantages of assumable mortgages, your next question may be about locating properties that offer these types of loans. We are here to guide you through this process.

We’re here to walk you through various ways to find these sought-after properties in the real estate market.

Utilizing Real Estate Platforms

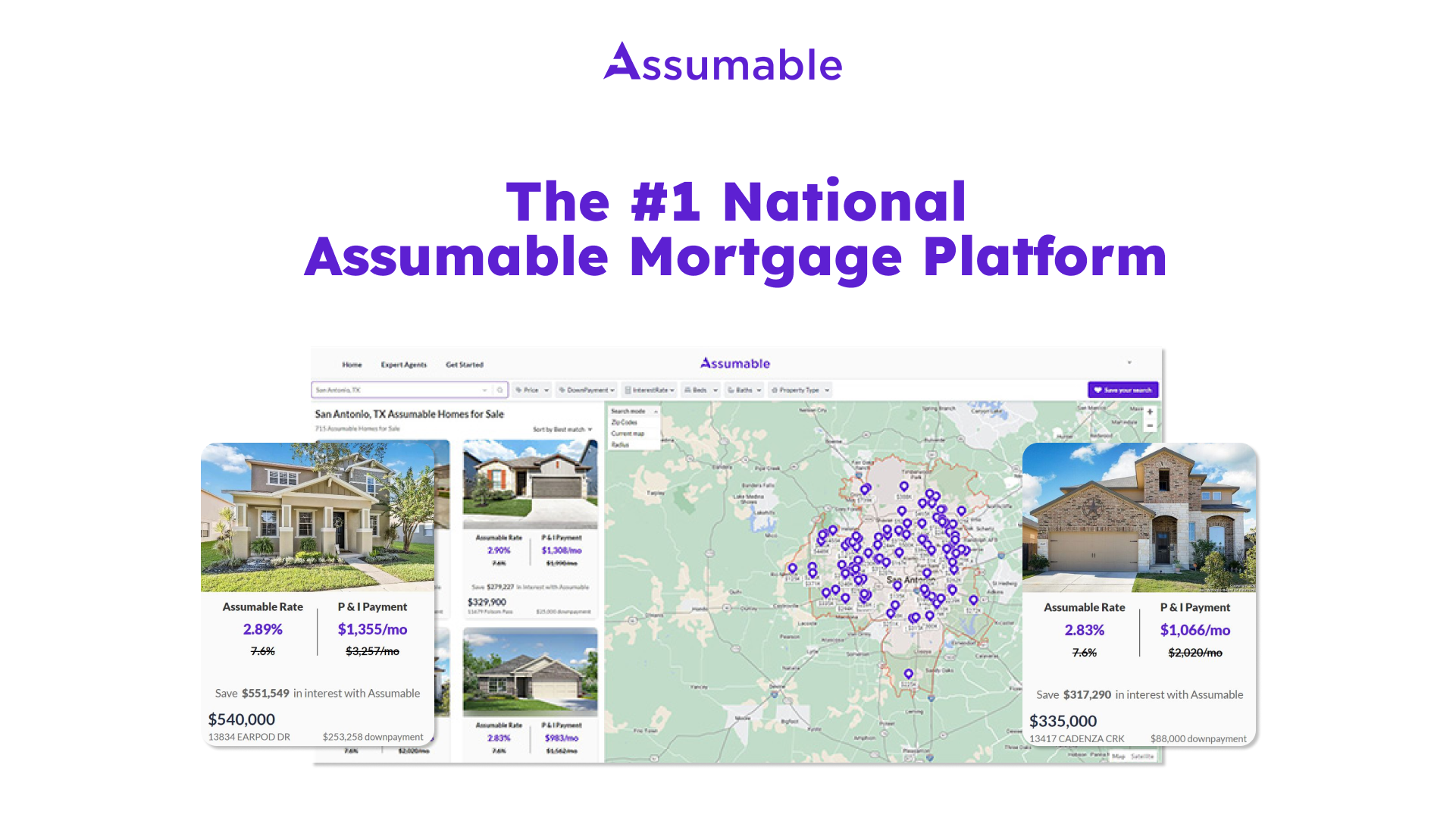

In the modern era of digital technology, utilizing online real estate services is an invaluable asset. Platforms such as Assumable.io and Roam excel in pinpointing properties that come with assumable mortgages by facilitating direct connections between potential buyers and sellers. By implementing keyword searches for terms like ‘Assumable mortgage’ or ‘VA loan,’ you can swiftly sift through listings to find homes offering assumable mortgages.

Harnessing these powerful tools means that the path to acquiring your ideal home is merely a mouse click away!

The Role of Real Estate Professionals

Do not overlook the expertise of an experienced real estate agent even with abundant online resources at your disposal. These professionals have access to unique listings and networks which may lead you to homes with assumable mortgages that aren’t listed publicly, This expands your range of options as you look for a new home.

Real estate agents can provide their wealth of knowledge to guide you towards properties where the possibilities of loan assumption exist, offering you a significant advantage in in your mission to find the perfect home.

Networking and Word-of-Mouth

Combining online resources and engaging with real estate experts, actively networking can lead you to opportunities involving assumable mortgages. By connecting with local real estate investment communities or discussion boards, you could uncover information about homes that come with assumable mortgages. This proactive approach can offer you early access to listings of properties featuring an assumable mortgage through tips from well-networked agents before these homes are widely advertised on the market.

Essential Criteria for Assumable Mortgage Eligibility

When you’re trying to discover how to find assumable mortgages, it becomes crucial to fully understand the key criteria for eligibility related to an assumable mortgage. Let’s look more into these essential prerequisites.

Government-Backed Assumable Mortgages

Previously, we discussed how assumable mortgages are mainly linked to government-backed loans such as those from FHA, VA, and USDA. With USDA loans in particular, assuming the mortgage is subject to certain approvals that must be obtained both from the lender and the USDA itself.

When it comes to mortgages backed by FHA, assuming an existing loan provides the advantage of retaining the original loan terms. This includes preserving fixed interest rates and minimizing closing costs – offering potential financial benefits of stepping into this kind of mortgage. If you take on an FHA mortgage where the initial down payment was below 10%, expect that you will have to continue paying monthly insurance premiums for this mortgage until it’s paid off.

Meeting the Requirements

Assumable mortgages present an attractive option for homebuyers, but they come with their own set of standards. To assume an FHA loan, most lenders suggest a minimum credit score of 580. On the other hand, for a VA loan assumption, a credit score of at least 620 is usually required.

The debt-to-income ratio is key when it comes to assuming an FHA mortgage. Ideally, it should not exceed 43%. As with any mortgage process, showing reliable financial stability is a must. This means proving satisfactory assets and proving your creditworthiness by fulfilling all required paperwork.

Financial Considerations When Assuming a Mortgage

Taking on a mortgage comes with specific financial aspects to consider. These include evaluating the seller’s equity in the property and planning for extra expenses that may arise. Here, we aim to simplify the financial factors associated with assuming a mortgage.

Assessing the Seller’s Equity

Assuming the mortgage of a seller means assuming not only their outstanding debt but also their accumulated equity in the property. Equity represents the value of the home minus any loan balances attached to it. As a purchaser, you’re responsible for compensating the seller for this built-up equity, which might require a substantial initial down payment.

Budgeting for Additional Costs

When considering how to find assumable mortgages, apart from taking on the seller’s equity, it is important to prepare for some additional costs that come with this process. These might stretch from fees related to assuming the loan, to processing expenses, and payments to the lender’s legal representative. The specific amounts can vary based on which type of mortgage you’re taking over. For example, when it comes to VA loans specifically, there are typically small funding fees representing 0.5 percent of the outstanding loan balance along with approximately $300 as a processing charge.

You must also account for any discrepancy between what remains owed on that assumable mortgage and today’s market value of the property itself. This can be done either by directly paying the difference or by obtaining alternate financing like a second mortgage loan. Consequently, while assumable mortgages might offer financial advantages under certain circumstances, they require careful financial planning ahead as well.

Navigating the Assumption Process

Let’s explore the process of assuming a mortgage now that we have looked at the financial aspects. We’ll walk step-by-step through the stages, from interacting with lenders and tackling legal issues to finalizing the property transfer.

Engaging with Lenders

The first step in understanding how to find assumable mortgages is getting approval from the initial lender. This involves submitting your financial information and undertaking an underwriting process much like you would for a conventional mortgage application.

Following approval, your next task is preparing a release of liability. This important document formally shifts responsibility for the mortgage from the seller to the buyer, ensuring a smooth and secure transition of loan responsibilities.

Legal and Contractual Aspects

Taking over a mortgage is a process embedded with legal and contractual complexities, requiring attention to detail. Bringing a real estate attorney can help evaluate the mortgage contract to verify whether the loan is assumable.

This professional can offer insights into whether a mortgage that does not explicitly indicate it’s assumable can still be assumed. They also play an essential role in reducing potential hazards—for instance, ensuring that after the loan transfer through the assumption takes place, the original seller is released from liability if they haven’t yet secured lender approval for their release from obligation.

Finalizing the Transfer

Once the lender approves the mortgage assumption, you, as the buyer, will receive the property title and take responsibility for monthly mortgage payments. Keep in mind that this approval could take up to 90 days, which may extend beyond the normal timeframe of conventional mortgage application procedures.

In this final phase, it’s critical to reconcile any difference between the current market value of the home and the outstanding principal balance. This financial gap may be bridged either by a direct down payment or through securing an additional secondary loan against your mortgage. Keep this in mind during these proceedings. During these proceedings, remember that there’s limited scope for negotiation as you’ll be dealing directly with your current lender.

Advantages and Challenges of Assumable Mortgages

At this stage, it’s clear that assumable mortgages come with a mix of benefits and potential drawbacks. They may offer lower interest rates than standard loans, reduce paperwork, and bring down closing costs. In situations where interest rates are high, the cost-saving benefits on mortgage payments can be considerable. For those selling a home with a low-interest-rate mortgage in place, promoting its assumability might provide an edge.

On the other hand, for buyers considering assumable mortgages:

- You could need to secure a second mortgage if the seller has substantial equity.

- Potential collaboration challenges among lenders might occur.

- The risk of defaulting on the loan may increase.

- Your lender options are limited.

When contemplating any financial decisions, including an assumable mortgage, it’s key to weigh every pro against the potential cons to evaluate if this choice suits your financial strategy.

Summary

We have explored everything from the basics of assumable mortgages to the steps of the assumption process. An Assumable mortgage offers a unique opportunity to step into the seller’s shoes and benefit from their existing mortgage terms. While they come with their own set of requirements and considerations, with the right resources and guidance, they can be a feasible route to owning a home with the right insights and direction. So, are you prepared to unlock the potential of an assumable mortgage?

Frequently Asked Questions

Are FHA loans assumable?

Certainly, while FHA loans can indeed be assumed, it is important to note that they come with specific limitations and regulations. For any FHA loan issued after December 15, 1989, the lender must give their approval for the loan assumption to proceed. An evaluation of the creditworthiness of the prospective buyer might also be necessary as part of this process.

How do you find out if a seller has an assumable mortgage?

Examine your mortgage contract for an assumption clause, as it indicates the mortgage is assumable and allows you to pass on the mortgage obligation to someone else.

Do assumable mortgages still exist?

Certainly, assumable mortgages remain available, including those that are government-backed like FHA, VA, and USDA loans. Under certain conditions, some conventional loans may also be assumable. Prospective buyers must satisfy specific requirements and secure approval from the lender to take over the mortgage.

How hard is it to find an assumable mortgage?

Locating a seller who is cooperative and has an assumable mortgage available can present difficulties. Even upon finding such a mortgage, the qualification process may prove to be challenging due to the necessary initial financial outlay.

What are the eligibility criteria for assumable mortgages?

Potential purchasers aiming to take over an existing mortgage must meet credit requirements and adhere to the debt-to-income ratio guidelines set by federally-backed lending programs, which include FHA, VA, and USDA loans.

Are VA loans assumable?

Yes, VA loans are assumable, which means that if you find a home with a VA loan, you may be able to take over the seller’s mortgage terms. This could be a significant benefit, especially if the current loan has a lower interest rate than what’s currently available in the market. However, not all VA loans are assumable due to certain restrictions.

If a non-veteran assumes my loan do I lose my VA loan benefit?

It’s also worth noting that if a non-veteran assumes the loan, the original veteran’s entitlement may remain tied up in the mortgage until the loan is paid off, which can affect the veteran’s ability to obtain another VA loan in the future. Therefore, it is crucial for both the buyer and seller to fully understand the implications of assuming a VA loan.