Navigating the path to homeownership is like charting a course to your own slice of the American Dream. As someone taking your first steps into the real estate market, you’re not just looking for a house; you’re crafting the setting of your future life stories. There’s one lesser-known yet potentially advantageous pathway worth considering: assumable mortgages. These financial vessels can sail you to unexpectedly pleasant shores, provided you understand the waters you’re treading.

In this comprehensive guide, we’ll journey through the mechanics of assumable loans, weigh their advantages against the drawbacks, and offer insider tips to help you determine if this is the route to your new home.

How Assumable Mortgages Work

The Basics:

An assumable loan or mortgage is an existing mortgage that can be transferred from a seller to a buyer. The interest rates of yesteryears – perhaps the stunning 2’s, 3’s, or 4’s – can become your reality, even as rates climb beyond 6%+ today.

The Steps to Assume a Mortgage:

- Find a Selling Party with an Assumable Mortgage: It starts with a treasure hunt for a home you love, backed by a loan willing to change hands.

- Qualification: Get qualified by the lender, proving that you can shoulder the payment responsibilities of the assumable mortgage.

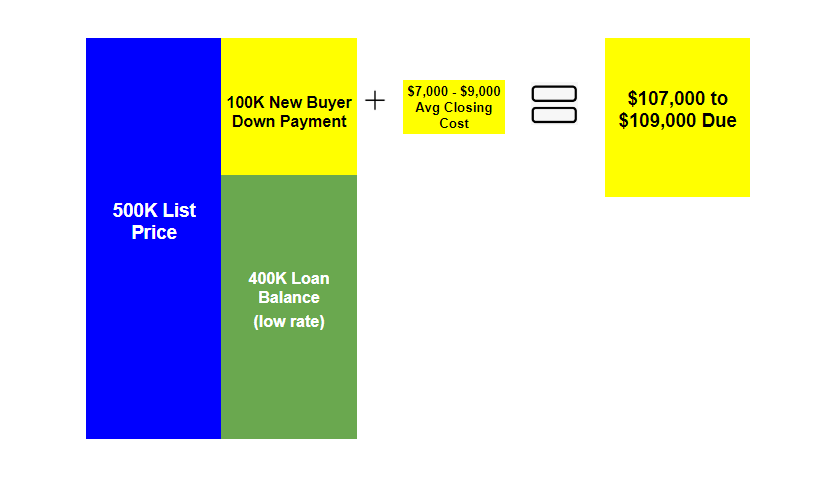

- Agreement on Terms: If you’re navigating the iceberg of the seller’s equity – the part of the home’s value not covered by the mortgage – prepare to negotiate. Depending on when the seller purchased their home, they may have significant equity that the new buyer will have to pay the difference of. Below is an example of a seller with a 500K listing on the market and they have a remaining mortgage of 400K. The difference between the 500k and 400k will be negotiated on during the initial offer.

Assumable Mortgage Example:

- Final Approval and Transfer: With the lender’s green light, dock this mortgage in your name, and the keys, the future, are yours.

Pros of Assumable Mortgages

Economical Euphoria:

Imagine slicing your monthly mortgage payments like a hot knife through butter. That’s the joy of a low-interest rate assumable loan – the initial taste of financial flexibility for many.

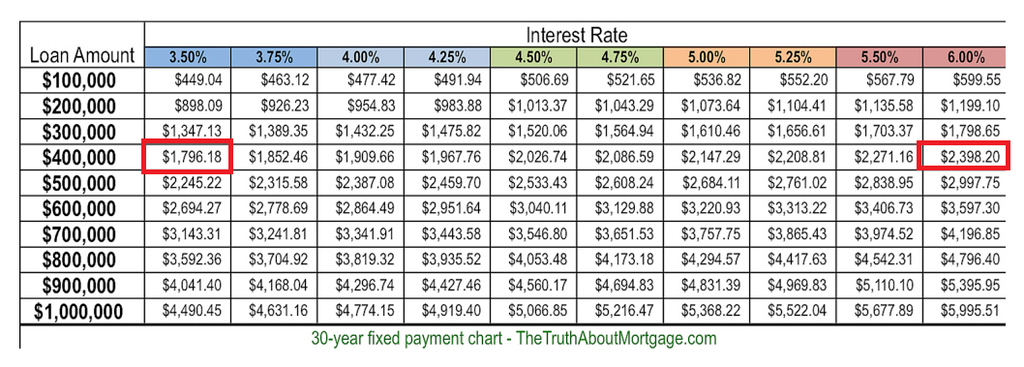

Lets take the initial example and continue with it! If you were to assume that seller’s remaining loan balance of $400k at a 3.5%, per the chart below, you would have approximately a $1,796.18 monthly mortgage compared to buying a home with traditional financing of 6%. The cost difference is over $600 per month!

Friend to Your Finance:

When the world says ‘high interest,’ and your mortgage whispers ‘affordability,’ embrace the satisfaction of bucking trends and saving where others simply can’t. You can get a significantly lower rate and have an easier time qualifying in some circumstances.

Cons: Navigating the Challenges

Equity Investments:

Your dream home comes with a price tag: you’ll need to cover the home’s value that surpasses the assumable loan. This palpable downside often calls for creative financing or a significant upfront investment. In the example above, after negotiating, you may still have a large payment due for the difference in the home value vs the loan balance.

The Waiting Game:

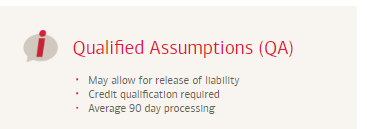

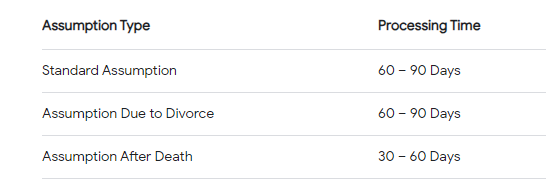

As assumable loans capture imaginations, anticipate longer approval times in to close based on processing times, underwriting and approval. An example of a newly posted article online from a national bank:

The Bridge Dichotomy:

A bridge loan can particularly befuddle the picture. Sure, you may bask in the low rate of the assumable loan, but the bridge loan’s higher rates might just offset your savings, leaving you to wonder if it’s worth the financial hopscotch. These rates can be between 8-12.5%

Expertise Scarcity:

Few agents possess the map to this treasure. Pinning down an assumable mortgage property requires a guide well-versed in this particular real estate lore.

How to Get Through The Process

The terrain of assumable mortgages demands a clear map—and that’s where your expertise and due diligence come into play. From understanding how to qualify to identifying ‘assumable loan’ homes, your mission is to arm yourself with knowledge and the right partnerships.

Making the Right Call: Is an Assumable Mortgage for You?

In your quest for a place to call your own, the decision to assume a mortgage should not be taken lightly. Are you prepared to ride out the potential tide of extra expense to secure a lower interest rate? Is the financial landscape of your life ready for this journey? Here are the cornerstones for your consideration:

- Current and Future Rates: Compare the assumable rate to prevailing market rates and projections.

- Your Financial Wherewithal: Assess your ability to fund the equity difference.

- Long-term Perspective: Play the long game. Short-term trade-offs could lead to a brighter financial future.

By no means is it a simple ‘aye or nay.’ But, equipped with knowledge, guidance, and careful thought, an assumable loan could very well unlock the doors to your dream home.

Related Article: Assumable Mortgages