Join us for our monthly market digest, the one-stop solution for all your real estate queries! Our goal is to enlighten both buyers and sellers about the pulse of the real estate market. Remember, real estate is not a one-size-fits-all industry, every city has its unique tale. We’re here to identify whether it’s the right time for you to buy or sell.

When it comes to negotiations, we’ve got your back! We’ll help you understand the players in power and your position in the deal. Not just that, we are here to demystify the complex world of real estate prices. We’ll breakdown the cost per square foot, scrutinize the comparison between list prices and closing prices, and give you a heads-up on what sellers are offering to clinch a deal.

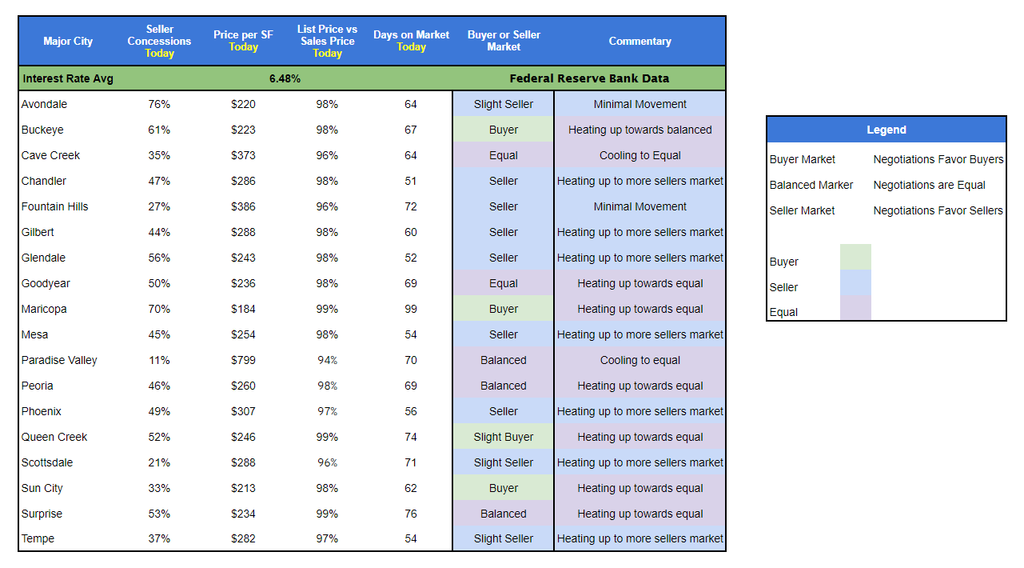

What Cities Are a Buyers or Sellers Market

Ever wonder if you’re shopping in a buyer’s or seller’s paradise? Our homework is done – we’ve crunched the real estate numbers so you won’t have to! Dive into our easy-to-digest breakdown below and discover which cities give buyers the upper hand, and where sellers are living the dream. 🏠✨ We further break this chart down below!

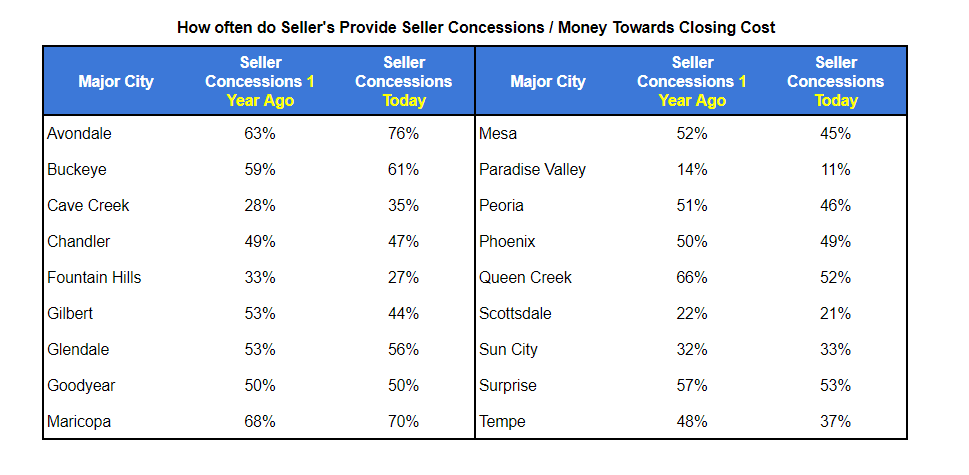

Seller Concessions

***A seller concession refers to a contribution made by the seller to help cover the buyer’s closing costs or other expenses associated with the home purchase

Buyer’s are currently using seller concessions to aid in buying down interest rates to make their mortgage payments more affordable

Buydown to Reduce Your Mortgage Interest Rate

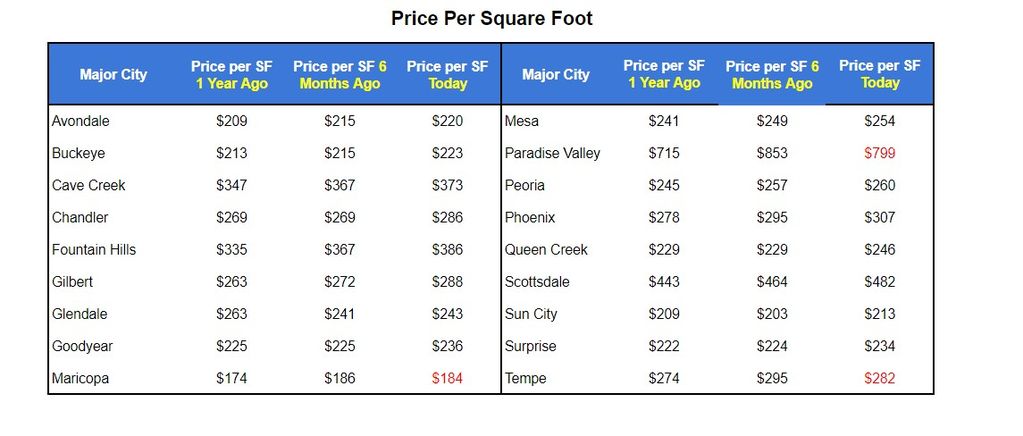

Price per Square Foot

In light of current changes in interest rates, monitoring the price per square foot in various cities has become essential in the real estate market. Notably, we have witnessed interest rates hit as high as 8%, higher than the past twenty years+, but we are still seeing overall prices continuing to rise. Below, you will see all cities have increased over 1 year and over the last 6 months outside of Maricopa, Paradise Valley and Tempe. This analysis is valuable for buyers who are currently looking at costs or other expenses associated with the home purchase. As interest rates continue to fall, pent up demand will continue to impact home prices.

Find out what you qualify for before prices go up further

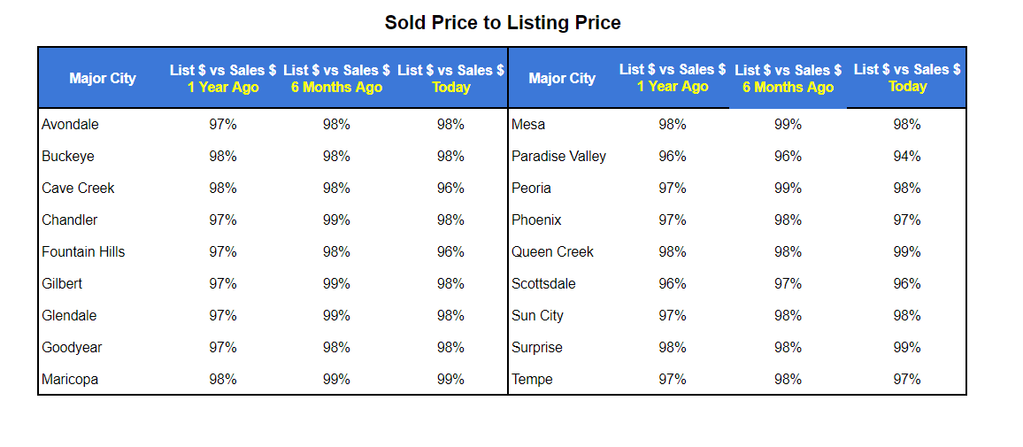

Sold Price vs List Price

The difference between a home’s final selling price and its original listing price serves as a key measure of negotiation trends in real estate. It shows the extent of negotiation both buyers and sellers have. Sellers can identify their success in striking a good deal, and buyers can determine how much pricing flexibility they have. This measure is a useful tool, providing insights into market dynamics and supporting informed decision-making during the complex home buying or selling process.

Example:

- A home is listed for $500,000 in Chandler, the average home sold price (after all negotiations have taken place) was 98% so the buyer’s closed for roughly $490,000.

- A home is listed for $1,500,000 in Paradise Valley would close at 94% of the list price at roughly $1,410,000.

Examples: Using the above information to help you navigate the market

- Buying a home in Peoria, Arizona at $450,000 (at a sf price of $260) you will get roughly a home that is 1,730 SF

- Currently this location is a balanced market and is increasing slightly towards seller for negotiation purposes

- You have a 46% chance of receiving seller concessions, ranging from 2-15k, to help pay for your closing costs and money for a rate buy down

- After all negotiations, your sold price will be roughly $441,000

- Buying a home in Chandler, Arizona at $450,000 (at a sf price of $286) you will get roughly a home that is 1,573 SF

- Currently this location is a sellers market where the seller may have more in their favor during negotiations

- You have a 47% change of receiving seller concessions, ranging from 2-10k, to help pay for your closing costs and money for a rate buy down

- After all negotiations, your sold price will be roughly $441,000

- Buying a home in Buckeye, Arizona at $450,000 (at a sf price of $223) you will get roughly a home that is 2,017 SF

- Currently this location is a buyer market where the buyers may have more in their favor during negotiations

- You have a 61% change of receiving seller concessions, ranging from 8-20k, to help pay for your closing costs and money for a rate buy down

- After all negotiations, your sold price will be roughly $441,000

Conclusion – What does this all mean?

In the constantly changing world of real estate, the value of a well-informed agent and lender is paramount. Their guidance helps you understand complex market trends leading to better decisions. A competent agent uses negotiation skills effectively, securing rewarding deals for all parties involved. Likewise, an astute lender assists in handling financial complexities, obtaining terms that meet your objectives. As market conditions vary and negotiation dynamics alter, having a reliable team at your disposal is the secret to a fruitful real estate venture.

Let us be your agent matchmaker

Sources

ARMLS

Federal Reserve Bank Data